The Markets Brace for Inflation

With the return of Trump’s policies to the forefront of economic discussions, markets are gearing up for a potential wave of inflation. The focus on tariffs and immigration restrictions reignites concerns about rising costs and tighter labor markets. However, history—and the forces of technology—tell a different story. Could this potential inflationary pressure give way to a long-term deflationary trend?

This blog explores how Trump’s policies, technological advancements like AI, and demographic shifts interact, using the Cobb-Douglas production formula as a framework to better understand the forces at play.

Inflationary Forces of Trump’s Policies

1. Tariffs and Trade Policies

Tariffs, a cornerstone of Trump’s economic approach, increase the cost of imported goods and raw materials. For businesses reliant on global supply chains—such as manufacturing, electronics, and agriculture—this means higher production costs. These costs are often passed on to consumers, pushing prices higher and driving inflation.

2. Immigration Restrictions

Stricter immigration policies reduce the availability of labor, particularly in industries like agriculture, construction, and hospitality, which heavily rely on immigrant workers. Labor shortages lead to rising wages, which further increase production costs and consumer prices.

3. A Short-Term Inflationary Spike

The combined effects of tariffs and tighter labor markets create a perfect storm for inflation in the near term. Businesses facing higher input costs and limited access to labor will adjust their pricing accordingly, reinforcing inflationary pressures.

Technology and Historical Deflationary Trends

Productivity Gains Drive Deflation

One of the biggest drivers of deflation throughout history has been technological progress. Take the Industrial Revolution, for example. Before steam engines and machinery, most goods were handcrafted, which made them expensive and time-consuming to produce. But when factories automated production, costs plummeted, and goods became affordable to the masses. This wasn’t just a one-time shift—it set the stage for decades of economic growth and falling prices.

Fast forward to today, and we see similar trends with advancements in the internet, robotics, and now Artificial Intelligence (AI). Technology helps businesses do more with fewer resources, which keeps prices low even when other costs, like labor or materials, rise.

The Long-Term Trend Toward Deflation

While inflationary pressures may dominate in the short term, the long-term trend remains clear. Technology-driven productivity gains, combined with demographic shifts such as aging populations and declining birth rates, exert deflationary pressures. Lower consumption demand and higher savings rates reinforce this trend, making sustained inflation unlikely.

But to really understand how all of this works, let’s introduce a simple framework that economists use to measure how economies grow.

The Cobb-Douglas Framework: Bringing It All Together

1. A Simple Framework for Understanding Growth

Economists use a tool called the Cobb-Douglas production function to explain what drives economic growth. Don’t worry—it’s not as intimidating as it sounds! Here’s the gist:

Imagine the economy as a recipe. The final dish—economic output—depends on three key ingredients:

- Labor (L): The workers who roll up their sleeves and get things done.

- Capital (K): The tools, factories, and money needed to produce goods and services.

- Productivity (A): The secret ingredient that makes everything more efficient—this includes technology, innovation, and know-how.

The recipe looks like this:

This formula helps us see how different forces shape the economy. For example:

- If labor is scarce, like when immigration policies reduce the workforce, prices tend to rise (inflation).

- If capital becomes more expensive, like when tariffs increase the cost of raw materials, businesses pass those costs on to consumers.

Here’s the deal: Productivity (A) is the ultimate equalizer. Technological advancements drive efficiency, helping to counterbalance rising costs and stabilize prices.

2. Why AI is a Game-Changer

AI doesn’t just tweak productivity—it revolutionizes it. Unlike traditional tools, AI can continuously learn, adapt, and improve, making it an accelerator for both labor and capital:

- In manufacturing, AI-powered robots produce goods faster and cheaper than ever before.

- In logistics, AI predicts the most efficient routes, cutting transportation costs.

- In healthcare, AI-driven diagnostics improve patient outcomes while reducing medical expenses.

Because of its transformative power, some economists argue that AI deserves its place in the formula. While productivity (A) traditionally captures all technological progress, AI’s exponential impact might mean it needs a category of its own.

The Likely Outcome: Inflation or Deflation?

1. The Counterargument: Are Inflationary Pressures Here to Stay?

The U.S. government is currently navigating some staggering fiscal challenges: a $36 trillion national debt, a $2 trillion annual budget deficit, and a persistent trade deficit. Critics, including prominent voices like Peter Schiff, argue that this situation is unsustainable, especially during peacetime and an economic boom. The fear is that the government will continue fueling growth at any cost, potentially resorting to printing money to service maturing debts, ultimately devaluing the dollar.

Adding fuel to these concerns, Trump himself has openly expressed a preference for a weaker dollar. If faced with a choice between inflation and growth, the argument goes, Trump’s track record suggests he’d likely prioritize growth—even at the expense of price stability.

This is a sound and logical argument and one that resonates with many market participants. It’s also an argument I personally held close for years.

2. A Promising Counterbalance: Actions vs. Words

However, when you separate Trump’s rhetoric from his actions, a different picture begins to emerge. One of the most promising signals from his administration is the appointment of Scott Bessen as Treasury Secretary. Alongside him are influential figures like Elon Musk and Vivek Ramaswamy, who have taken leadership roles in the Department of Government Efficiency (DOGE). These individuals are outspoken advocates for reducing government spending and improving fiscal discipline—positions that could counterbalance inflationary pressures.

This is the most credible team focused on reigning in government excess that we’ve seen in years. Their agenda could pave the way for more sustainable fiscal policies, reducing the likelihood of runaway inflation.

3. Are Markets Overpricing Inflation Risks?

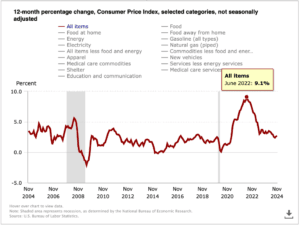

Let’s take a closer look at the current market environment. Long-term interest rates are higher now than they were in June 2022, despite inflation sitting at 2.7% compared to its peak of 9.1% in mid-2022. This disparity suggests that markets are pricing in a far worse inflationary scenario than the data currently supports.

If inflation fails to rear its ugly head in the way markets seem to anticipate, we could see a sharp snapback in interest rates. This creates a scenario where long-term bonds (duration) become one of the most compelling investment opportunities in recent memory.

4. Why Current Yields Look Attractive

Even with the uncertainty, today’s market presents some attractive opportunities:

- 10-Year Treasury Yields: At over 4.5% with inflation at 2.7%, Treasuries are offering a real yield of approximately 2%—a rarity in recent years. This provides investors with a meaningful return above inflation.

- Earnings Yield Comparison: A common rule of thumb is that when the 10-year Treasury yield exceeds the stock market’s earnings yield, equities might be overvalued. With the 12-month forward earnings yield currently at 4.2%, Treasuries at 4.6% (as of January 2025) look particularly appealing.

Comparing earnings yields to Treasury yields helps investors assess the relative attractiveness of stocks versus bonds. The earnings yield tells you what percentage of a company’s stock price is earned in profits each year, giving a direct way to compare it to bond yields. Typically, investors expect higher returns from stocks to compensate for their greater risk compared to government bonds. However, when Treasury yields surpass earnings yields, it suggests that bonds may offer a more favorable risk-adjusted return.

5. The Role of Government Spending: A Double-Edged Sword

For every dollar the government spends, that dollar becomes revenue for someone else. When the government runs fiscal deficits, it’s essentially borrowing from future spending to fuel today’s economy. In recent years, this debt-fueled spending has been the primary driver of GDP growth. The lion’s share of economic expansion has come from government outlays rather than organic private sector growth.

But here’s where it gets tricky: with interest rates rising, the cost of borrowing is increasing dramatically, putting pressure on the government’s ability to maintain such high levels of spending. Compounding this challenge is the influence of fiscal hawks like Thomas Massie, Chip Roy, and Andy Biggs. Even just a handful of dissenters in Congress can block significant spending bills, especially in an environment where partisan divides are growing sharper.

Adding to this, initiatives like the Department of Government Efficiency (DOGE)—led by reform-minded figures like Elon Musk and Vivek Ramaswamy—are bringing more transparency to government waste. These factors combined make it less likely that government spending will continue at the pace markets may be pricing in.

And this brings us to the crux of the argument: if government spending—the primary driver of recent GDP growth—is forced to contract, the resulting drop in fiscal stimulus would likely be deflationary. With less money flowing into the economy from government outlays, overall demand could weaken, putting downward pressure on prices and growth.

Conclusion: A Balanced Perspective on the Future

The markets today are grappling with a fascinating tug-of-war between inflationary and deflationary forces. While concerns about reckless fiscal policies and rising inflation remain valid, actions like appointing credible leaders and focusing on government efficiency offer a glimmer of hope for more disciplined spending.

But with Trump’s potential return, one thing is certain: uncertainty. And where there’s uncertainty, there’s also opportunity—if you know where to look. Navigating the economic shifts of a “Trump Era 2.0” will require more than a wait-and-see approach. It’s about preparing your portfolio to protect your financial situation when others are overly optimistic and vulnerable to surprises, while also keeping an eye for overlooked opportunities.

As a CFP® professional, I can help you design a financial plan that not only shields your assets against unforeseen events, but also positions you to seize opportunities where others see instability. At Brickell Financial Group, we’ll work together to create a personalized strategy designed to help you stay ahead of the curve—secure, informed, and ready for growth.