What if you could save thousands on taxes while building a powerful retirement fund—all without needing a traditional employer-sponsored plan? If you’re self-employed, a freelancer, or a small business owner, you might be sitting on one of the most underrated wealth-building tools: the Solo 401(k).

What is Solo 401(k) and how does it work?

Unlike standard retirement accounts, a Solo 401(k) lets you contribute as both the employer and employee, potentially doubling your savings. That means higher contribution limits, greater tax advantages, and full investment control. Yet, many entrepreneurs overlook this opportunity simply because they don’t understand how it works.

In this guide, we’ll break down everything you need to know: who qualifies, how much you can contribute, and how to maximize your savings for a secure financial future. Ready to take control of your retirement? Let’s dive in!

How to Qualify for a Solo 401k?

If you’re wondering who can open a Solo 401(k), the rules are simple:

- You must have self-employment income, whether from freelancing, consulting, or running a small business.

- You can’t have full-time employees (except for your spouse).

That means sole proprietors, partnerships, LLCs, and S corps can all take advantage. But what happens if you hire employees? If any of them work more than 1,000 hours per year, you’ll need to switch to a traditional 401(k) plan. However, part-time employees who work fewer than 1,000 hours annually are excluded from participation, so you can still keep your Solo 401(k) if they don’t exceed that threshold.

Now that you know who qualifies, let’s walk through the simple steps to get your Solo 401(k) up and running.

How to Set Up a Solo 401(k)

Setting up a Solo 401(k) is easier than you think. Here’s how:

- Pick a Plan Provider: Look for low fees, flexible investment options, and Roth contribution availability.

- Fill Out the Paperwork: Complete the plan adoption agreement and IRS forms.

- Get an EIN: You’ll need an Employer Identification Number from the IRS.

- Fund Your Account: Start making contributions based on IRS guidelines.

If you’re wondering how to open a Solo 401(k), how long it takes to set up, or when a Solo 401(k) needs to be established, keep in mind that setting up a plan before year-end can maximize tax benefits for the current year. Once your account is ready, the next step is understanding how much you can contribute and how to optimize your savings.

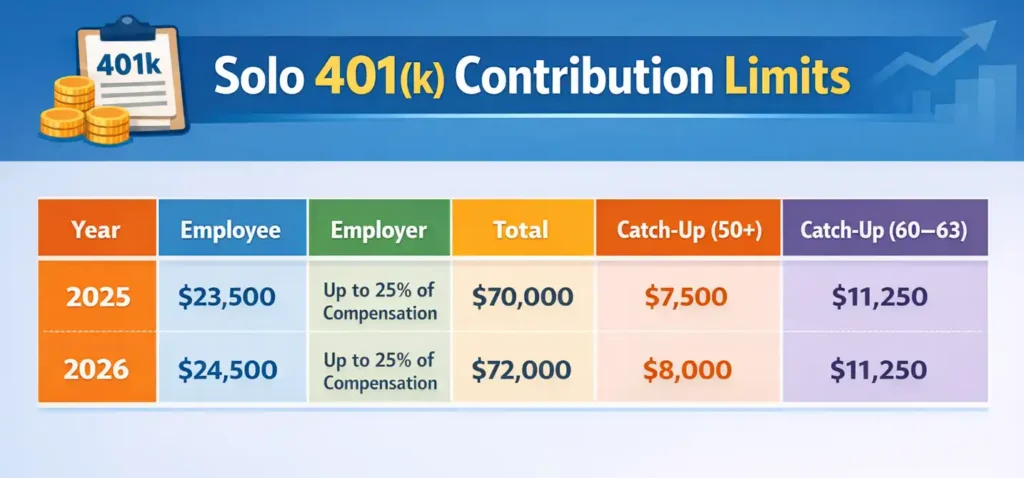

How Much Can You Contribute to a Solo 401(k)?

One of the biggest perks of a Solo 401(k) is that it lets you contribute from two different sources, effectively maximizing your retirement savings:

- Employee Contributions: Up to $24,500 (or $32,500 if you’re 50+).

- Employer Contributions: Up to 25% of compensation (for sole proprietors, this is calculated after self-employment tax deductions).

Total Limit: For 2026, combined contributions can reach $72,000 (or $80,500 if you’re 50+). Contribution limits are adjusted annually, make sure to check the IRS COLA increases for the current year.

Not sure how much you can actually contribute?

The rules look simple until you factor in business structure, spouse income, and tax strategy. That’s where most people either underfund their plan—or mess it up.

At Brickell Financial Group, we help self-employed professionals calculate the right Solo 401(k) contribution strategy based on real numbers, not IRS theory.

→ Talk to a Solo 401(k) specialist

How to Maximize Your Contributions

- Optimize Your Salary: A higher salary allows for bigger employer contributions.

- Leverage Catch-Up Contributions: If you’re 50+, that extra $8,000 can make a difference.

- Lower Your Adjusted Gross Income (AGI): More Solo 401(k) contributions mean a lower AGI, which can impact tax credits and deductions. (Check out How to Lower AGI for Tax Season.)

Household doubling: in certain situations, a household can effectively double the maximum total contributions by using two Solo 401(k) plans, one for each spouse. This means a married couple where both spouses are eligible plan participants and the working spouse has sufficient W-2 or owner compensation can reach combined contributions of up to $144,000 in 2025 (double the single-participant limit). This is especially powerful for small-business-owning couples who both take compensation from the business and want to maximize retirement savings together.

If you’re asking, “How much can I contribute to a Solo 401(k)?” or “How do I calculate Solo 401(k) contributions?”, the key is understanding the IRS rules for employer and employee contributions. Once you grasp these limits, you can create a strategy to maximize your savings and take full advantage of tax benefits.

What are the Tax Benefits of Contributing to a Solo 401(k)?

It offers two powerful tax-saving options:

- Pre-Tax Contributions: Lower your taxable income now; pay taxes on withdrawals in retirement.

- Roth Contributions: Pay taxes upfront; enjoy tax-free withdrawals later (as long as you’re 59½ and meet the five-year rule).

The Big Tax Savings

Your Solo 401(k) contributions can significantly reduce your taxable income, which is especially useful for those managing student loan repayments.

This is where most Solo 401(k) mistakes happen.

SECURE 2.0 changes, Roth-only catch-up rules, and income thresholds mean the “set it and forget it” approach no longer works.

At Brickell Financial Group, we help high-earning business owners structure Solo 401(k)s that align with their tax strategy, cash flow, and long-term goals.

→ Get help structuring my Solo 401(k)

For more on tax-efficient retirement planning, see What Pre-Retirees Need to Know About In-Service Rollovers.

With tax advantages in place, the next step is making smart investment choices to grow your Solo 401(k) and secure your financial future. Let’s explore your options.

Investment Options: What Can You Invest In?

One of the best parts of a Solo 401(k) is the flexibility to choose how you invest your funds. Unlike some retirement accounts that limit your options, a Solo 401(k) allows you to invest in:

- Stocks, Bonds, ETFs, and Mutual Funds – Traditional investments that provide growth potential and diversification.

- Real Estate – A self-directed Solo 401(k) lets you invest in rental properties, land, and other real estate assets.

- Alternative Investments – Depending on your plan provider, you may be able to invest in private equity, commodities, and even cryptocurrency.

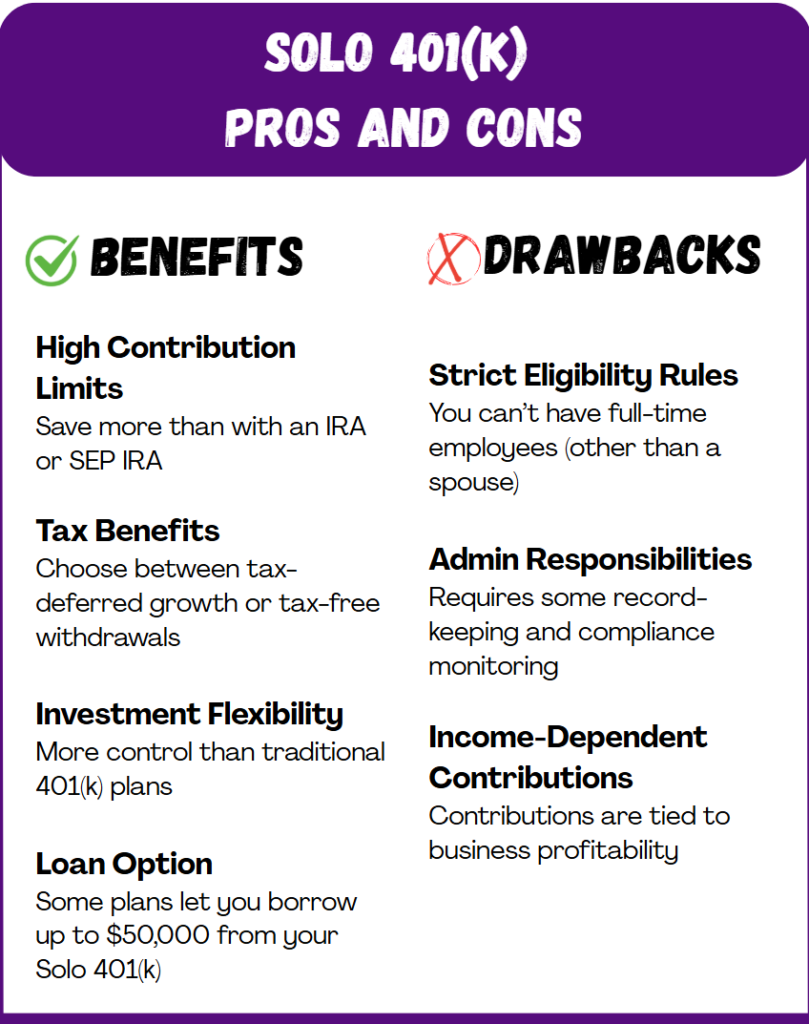

Solo 401(k) Pros and Cons

Like any financial tool, a Solo 401(k) comes with both advantages and challenges. Understanding the pros and cons can help you decide if it’s the right fit for your retirement strategy.

Thinking about early retirement? See Can You Retire at 50 with $2 Million?.

Common Solo 401(k) Myths—Busted

Misconceptions about Solo 401(k)s can prevent self-employed individuals from taking advantage of this powerful retirement vehicle. Let’s clear up some of the biggest myths.

Setting up a Solo 401(k) has never been easier, and navigating the process doesn’t have to be overwhelming. At Brickell Financial Group, we simplify the setup, ensuring it aligns with your retirement goals. With Schwab as the primary custodian, we assist in opening your account, exploring available options, and optimizing its benefits. Their low-cost structure helps keep expenses minimal, allowing you to focus on growing your retirement savings without unnecessary fees.

For more insights on accessing retirement funds, see Can I Cash Out My 401(k) While Still Employed?.

Is a Solo 401(k) Right for You?

If you’re self-employed and earning meaningful income, a Solo 401(k) can be one of the most powerful tools available—but only if it’s set up correctly.

At Brickell Financial Group, we help business owners design Solo 401(k) plans that maximize tax savings, avoid compliance issues, and fit into a bigger financial plan. We work with Schwab as the primary custodian, keeping costs low and investment options flexible.

If you want clarity—not generic advice—this is the next step.

→ Schedule a Solo 401(k) consultation

Brickell Financial Group Pedro: Brickell Financial Group LLC (BFG) does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Brickell Financial Group LLC cannot guarantee that the information herein is accurate, complete, or timely. BFG makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

The third-party trademarks and service marks appearing herein are the property of their respective owners.